How Australian financial firms can resolve cases faster and strengthen customer trust.

Executive roles

Trusted by leading banks across Australia

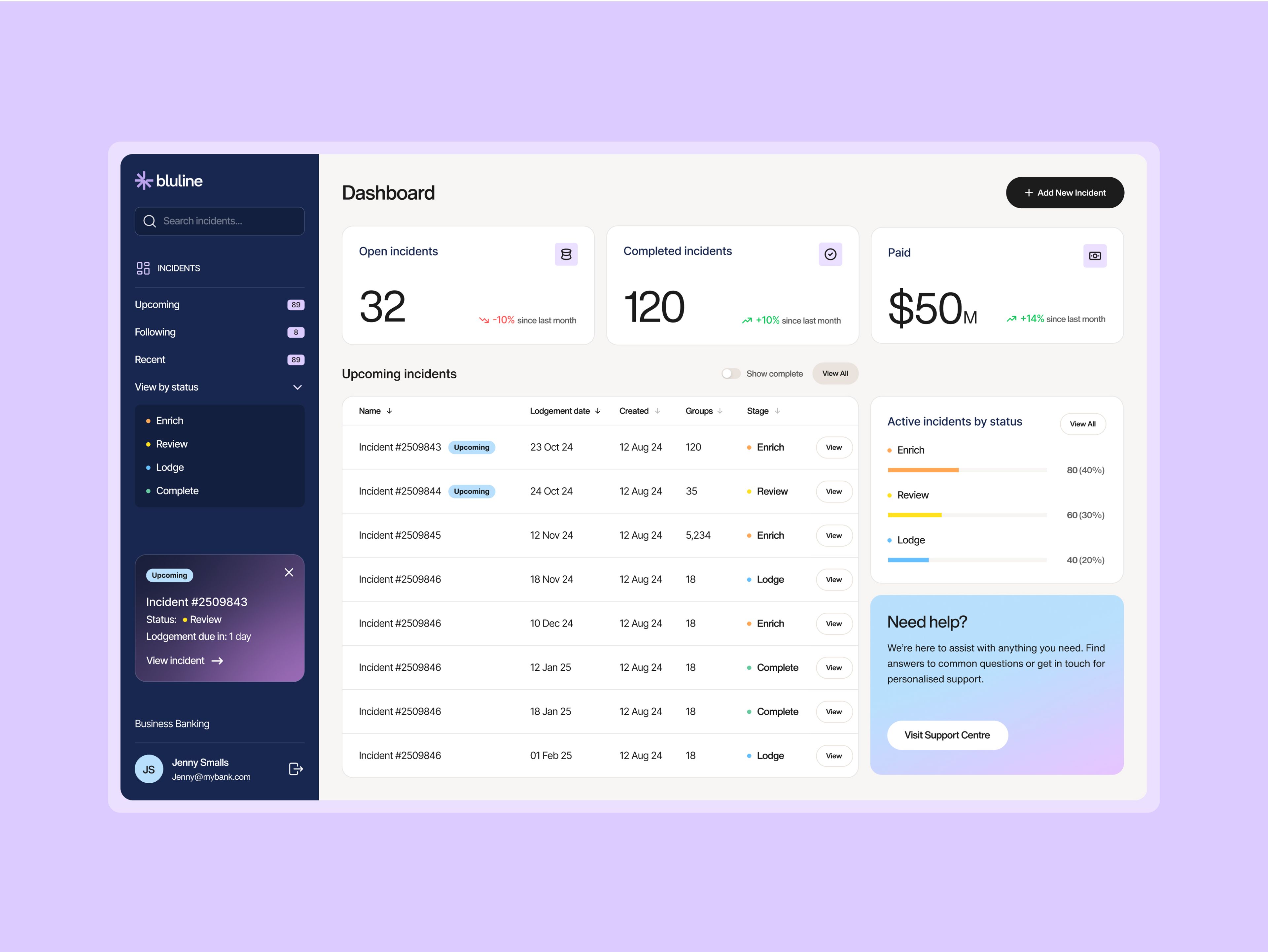

Leadership solution for remediation success

Today’s banking executives face compliance risks, manual processing challenges and increased head counts.

Bluline’s Platform ensures remediation is done right the first time and helps you deliver board-level priorities, such as closing out incidents, avoiding hefty fines and satisfying customers.

51M

Annual savings one top-tier Australian bank realised in the first year

4 month

Digital transformation time to value

240,000

Manual person-hours redeployed annually

4 week

Remediation cycle

Outpace the competition

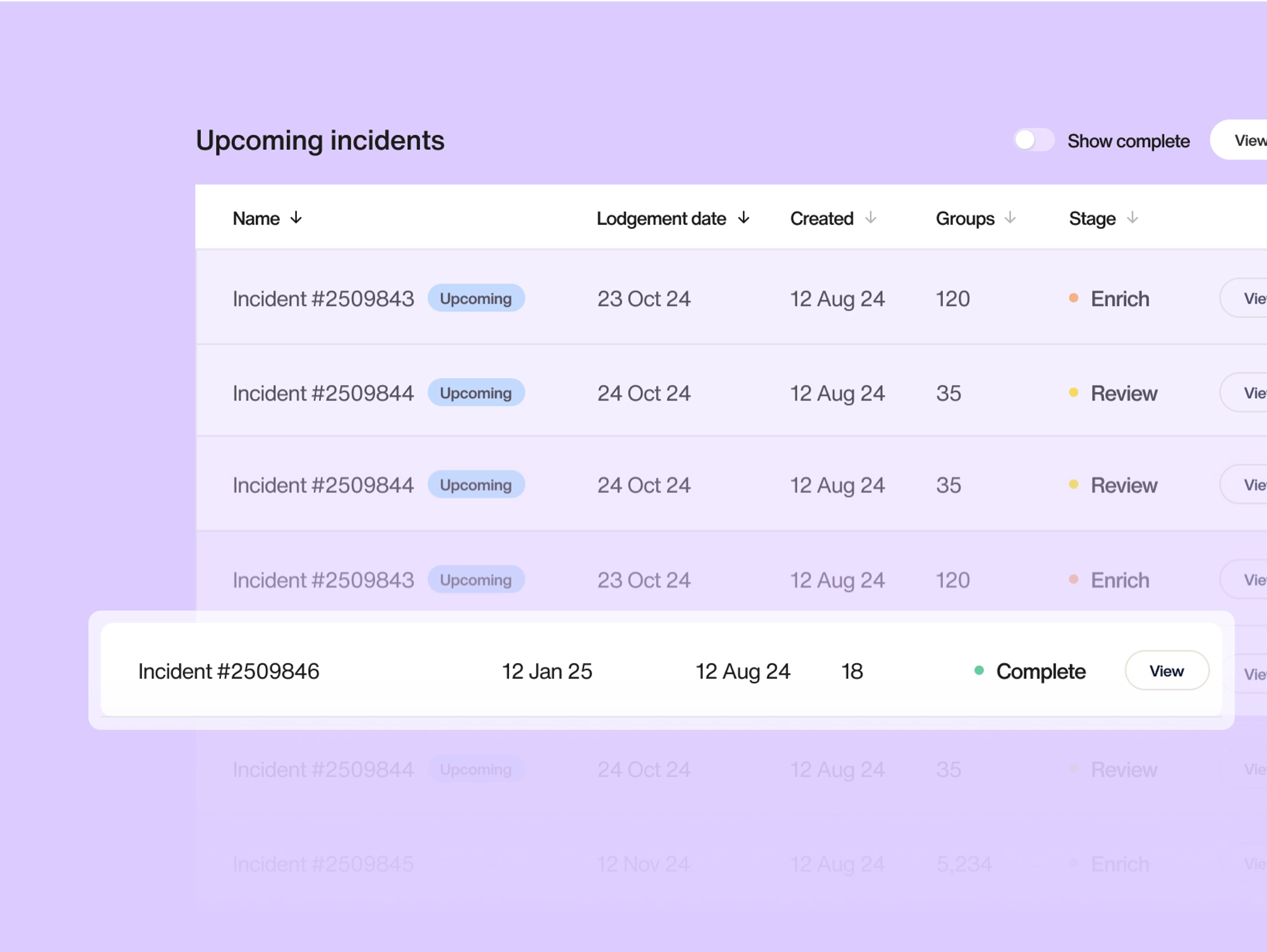

Gain a competitive edge with Bluline’s Platform, which quickly tackles backlogs and accelerates incident resolution.

Traditional remediation can drag on for 12 months, but with our Platforms help, your team can clear cases in just four weeks. You’ll see increased visibility and impactful results that resonate at the board level, demonstrating your bank’s clear value and operational excellence.

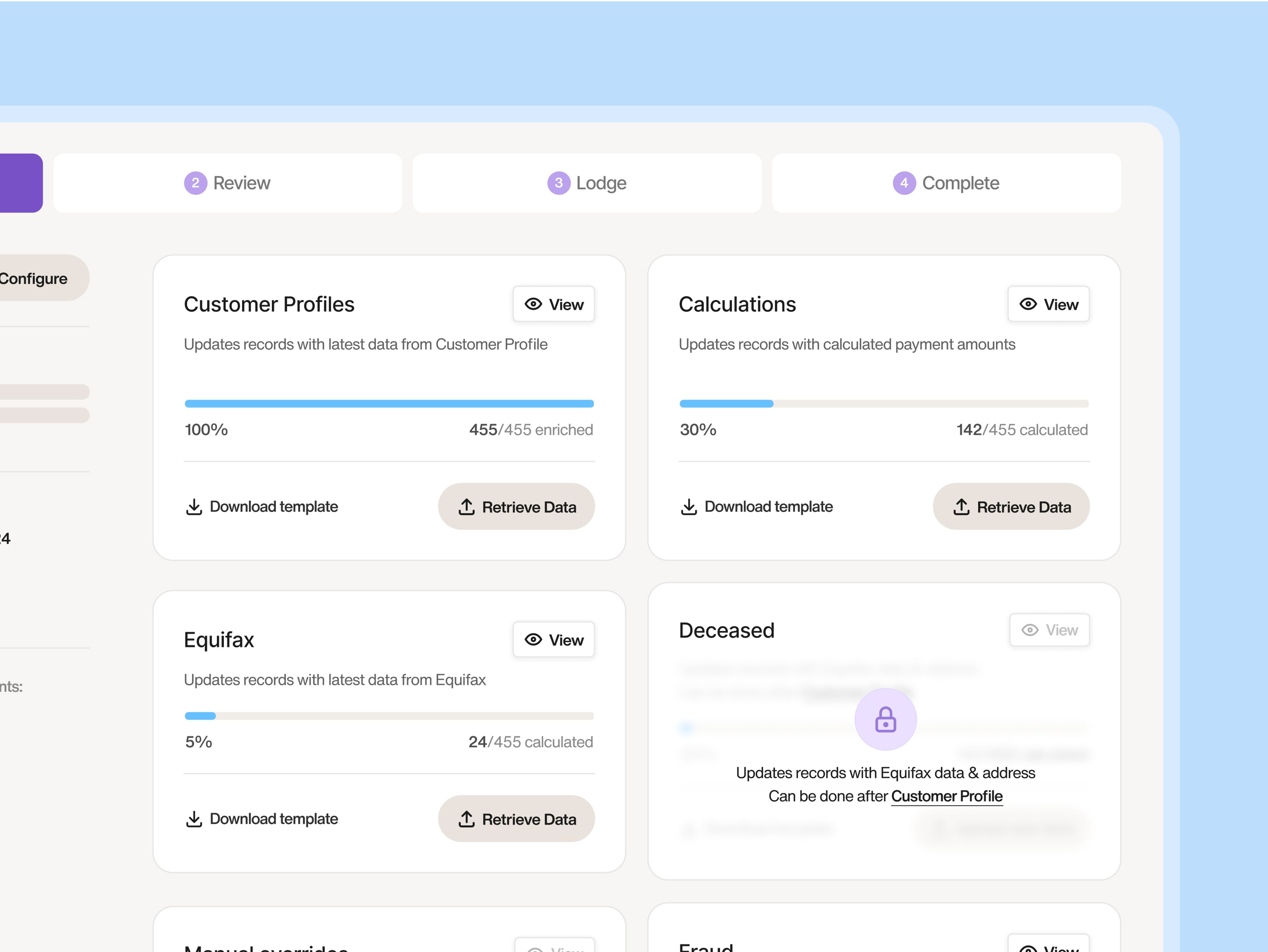

Ensure compliance, minimise risk

Mitigate risk effectively with our Platforms rule-based automation at the core of your remediation efforts. Make manual processing, error corrections, and extended incidents remnants of the past.

The Platform embeds compliance and precision into every step, transforming risk management into a streamlined, reliable process.

Optimise your workforce

Transform your remediation strategy with our Platform and shift from a headcount-heavy, labour-intensive process to a tech-driven approach.

Historically, teams spent months – even years – manually managing cases.

Now, a streamlined team can achieve the same results in as little as four weeks, allowing you to redeploy resources more effectively and enhance overall productivity.

“Bluline’s technology and engineering-first approach ensured seamless integration with our existing systems, allowing for minimal disruption and maximum impact. Their team worked hand in hand with Westpac and embedded themselves within our operations to create a tailored solution that meets both regulatory and business needs. Their deep collaboration, expertise, and commitment to delivering real results have been game-changing for the bank.”

See how our platform can work for you

Watch a demo to see how our platform can revolutionise your bank's remediation efforts

Discover insights from Bluline

View all insightsView all insightsThe Capital Brief piece explores how banks continue to wrestle with legacy issues as well as new ones triggered by technology updates, product rollouts, and regulatory shifts

Bluline Technologies takes is an engineering-first approach that simplifies remediation from start to finish—integrating all critical remediation stages into one seamless platform.

Discover how end-to-end automation is revolutionising customer remediation in banking – addressing challenges, enhancing customer trust, and driving operational efficiency.

Navigate the complexities of banking regulations with this compliance guide to ensuring trust, transparency, and streamlined customer remediation.

FAQ

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Absolutely! Bluline’s platform delivers proven results, successfully processing more than $50 million in payments to nearly 2 million Australian customers. It has efficiently managed more than 100 customer remediation incidents, helping banks streamline processes, reduce costs, and improve compliance. Our partner banks trust Bluline to transform their remediation efforts with measurable success.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Yes. Bluline offers confidential roundtable and executive whiteboard sessions to help banks assess their current customer remediation processes, identify challenges, and explore the impact of automation. These collaborative sessions provide valuable insights and strategic guidance. Contact us to learn how we can support your bank’s transformation.

Yes. Bluline’s platform is compliant by design, built to align with ASIC’s Regulatory Guide 277 and tailored to your bank’s specific requirements. It is adaptable to evolving regulations, ensuring long-term compliance. We work closely with regulators to uphold industry standards, providing a secure, transparent, and fully auditable remediation process.

Bluline partners closely with your bank to ensure a smooth onboarding process, embedding our team within yours to understand your specific customer remediation needs. We work as an extension of your team, tailoring automation to fit your workflows. With dedicated support and training, implementation is seamless, with timelines varying based on complexity.

Bluline’s end-to-end platform dramatically speeds up customer remediation – reducing timelines from months to weeks. Our automation streamlines every stage, from identifying impacted customers to executing payments and closing out incidents. You can now resolve in as little as four weeks what once took 12 months or more. That’s how much we improve efficiency, compliance, and customer outcomes.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.