How Australian financial firms can resolve cases faster and strengthen customer trust.

Remediation solved.

Our RegTech platform offers end-to-end automated customer remediation specifically designed for Australian banks

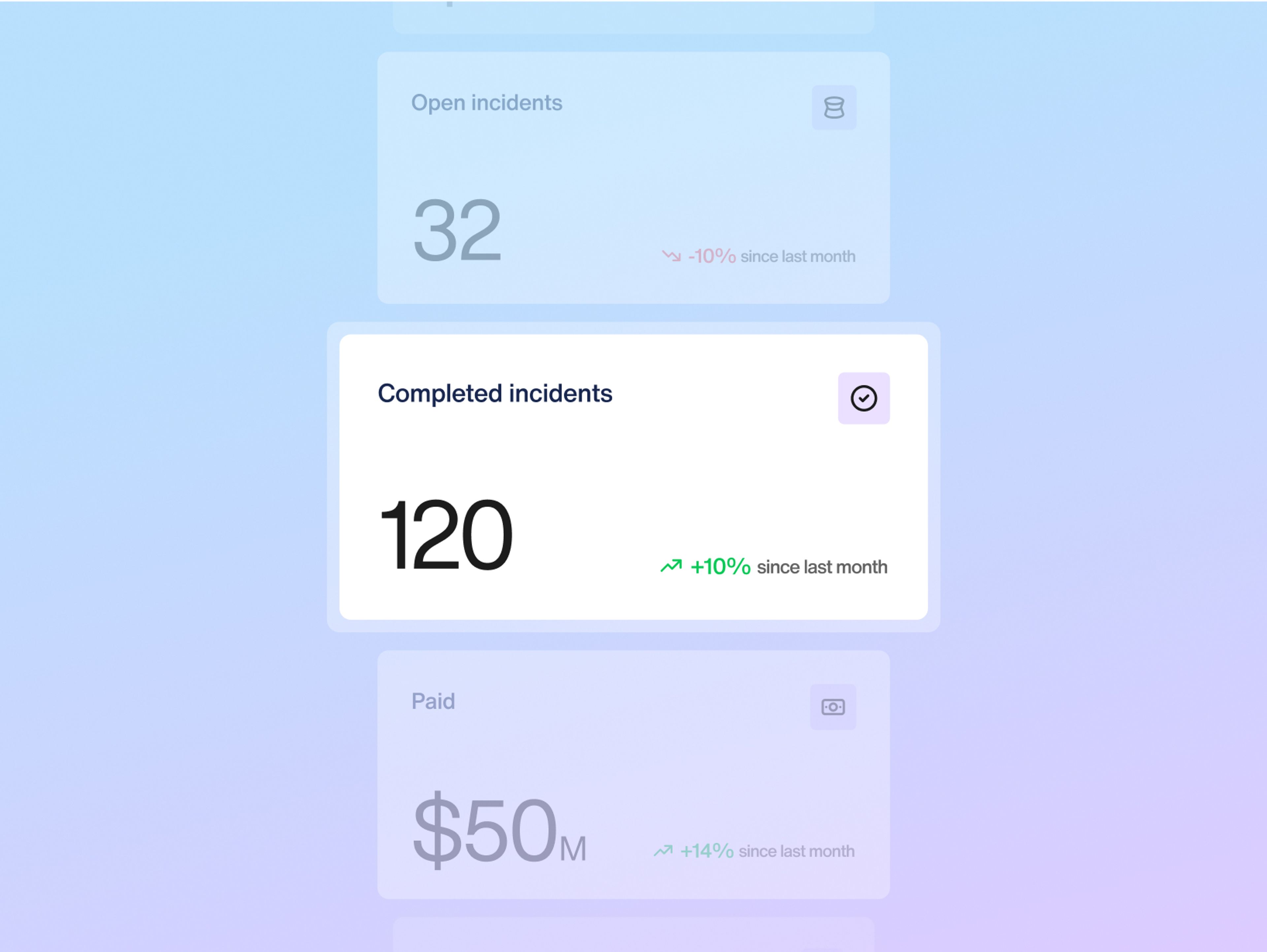

600%

Increased remediation efficiency

2x

Annual incident output

$51M

Average annual cost savings

4 week

Remediation cycle

Trusted by leading banks across Australia

Accurate, fast and cost-effective remediation

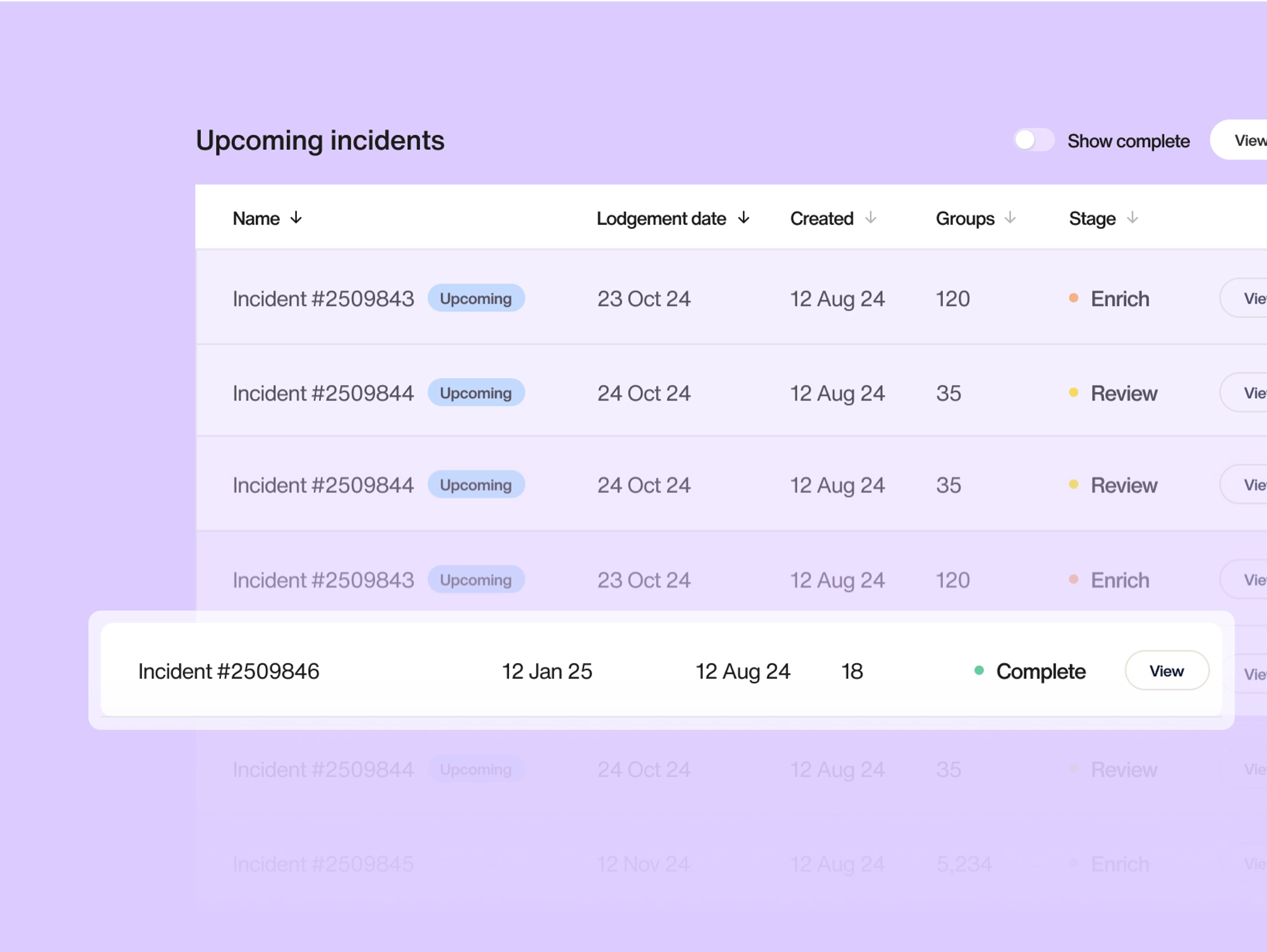

Automate remediation, accelerate resolution

It's a common misconception that you cannot automate processes if they have a high degree of variance and complexity, but you can! Our approach actively automates your remediation from end to end – from identifying impacted customers to closing incidents.

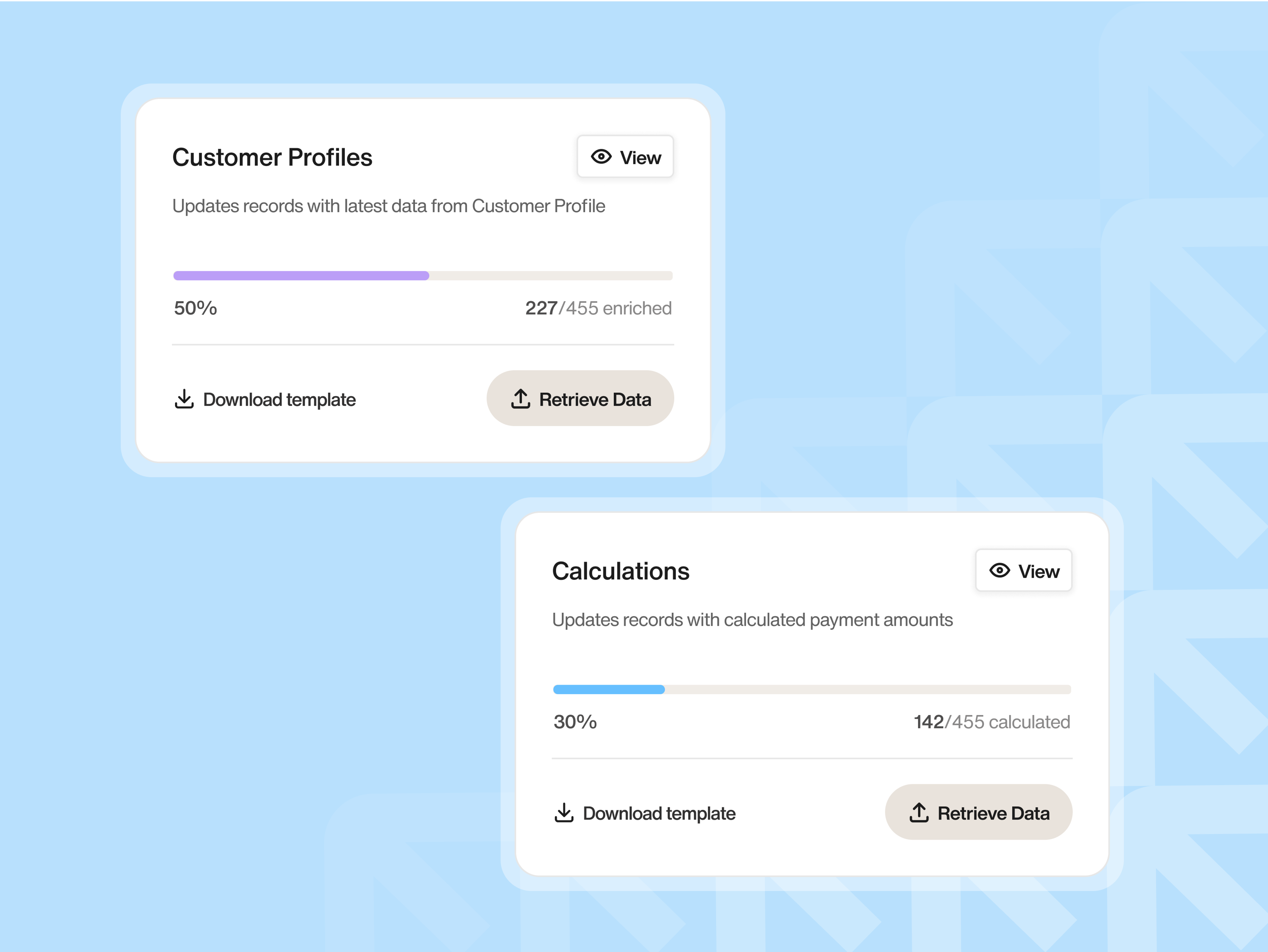

1. Determine payment eligibility

Gather details of potentially impacted customers and rules for calculating impact

2. Calculate customer impact

Use rules to review identified customers to determine principal loss and other impacts

3. Conduct compliance checks

Check compliance to determine deceased customers, bankruptcy, fraud, and more

4. Assign payment method

We cover every payment option, from payment into open accounts to payments to third parties – that is, ASIC or charity and exception scenarios

5. Generate email, letter, or SMS

Communicate specific incidents to customers, detailing how they’ve been impacted

6. Execute and confirm payment

Ensure seamless execution and confirmation of remediation payments

7. Simplify customer follow-up

Streamline payment follow-ups, demonstrating reasonable efforts, with automated tracking and customer contact management

8. Close out incidents and charity payments

Gain clear closure, reporting, and transparency after completing payments

An uncommon approach for uncommon success

Bluline provides an end-to-end, fast, cost-effective platform enabling your remediation team to realise bankable results.

With a deep understanding of the challenges and churn of being in the remediation trenches, we knew there had to be a better way than simply throwing more team members and cumbersome manual processes at remediation. We set out to find it – and we did.

Bluline’s remediation platform brings sophisticated automation to even the most complex or clunkiest remediation programs.

From determining customer eligibility at the start of the remediation process to ultimately ensuring receipt of customer payments, our end-to-end solution delivers high-quality, bug-free, and accurate outcomes with cutting-edge technology.

Client testimonial

“Bluline’s technology and engineering-first approach ensured seamless integration with our existing systems, allowing for minimal disruption and maximum impact. Their team worked hand in hand with Westpac and embedded themselves within our operations to create a tailored solution that meets both regulatory and business needs. Their deep collaboration, expertise, and commitment to delivering real results have been game-changing for the bank.”

Discover insights from Bluline

View all insightsView all insightsBluline Technologies takes is an engineering-first approach that simplifies remediation from start to finish—integrating all critical remediation stages into one seamless platform.

Key metrics, strategies, and tools can help you gauge the impact of your bank’s customer remediation efforts so you can improve processes and deliver better outcomes.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.