Discover how end-to-end automation is revolutionising customer remediation in banking – addressing challenges, enhancing customer trust, and driving operational efficiency.

Technology roles

Trusted by leading banks across Australia

Simplifying your complex tech challenges

Bluline was founded by software engineers with a technology-first approach and a background in financial services.

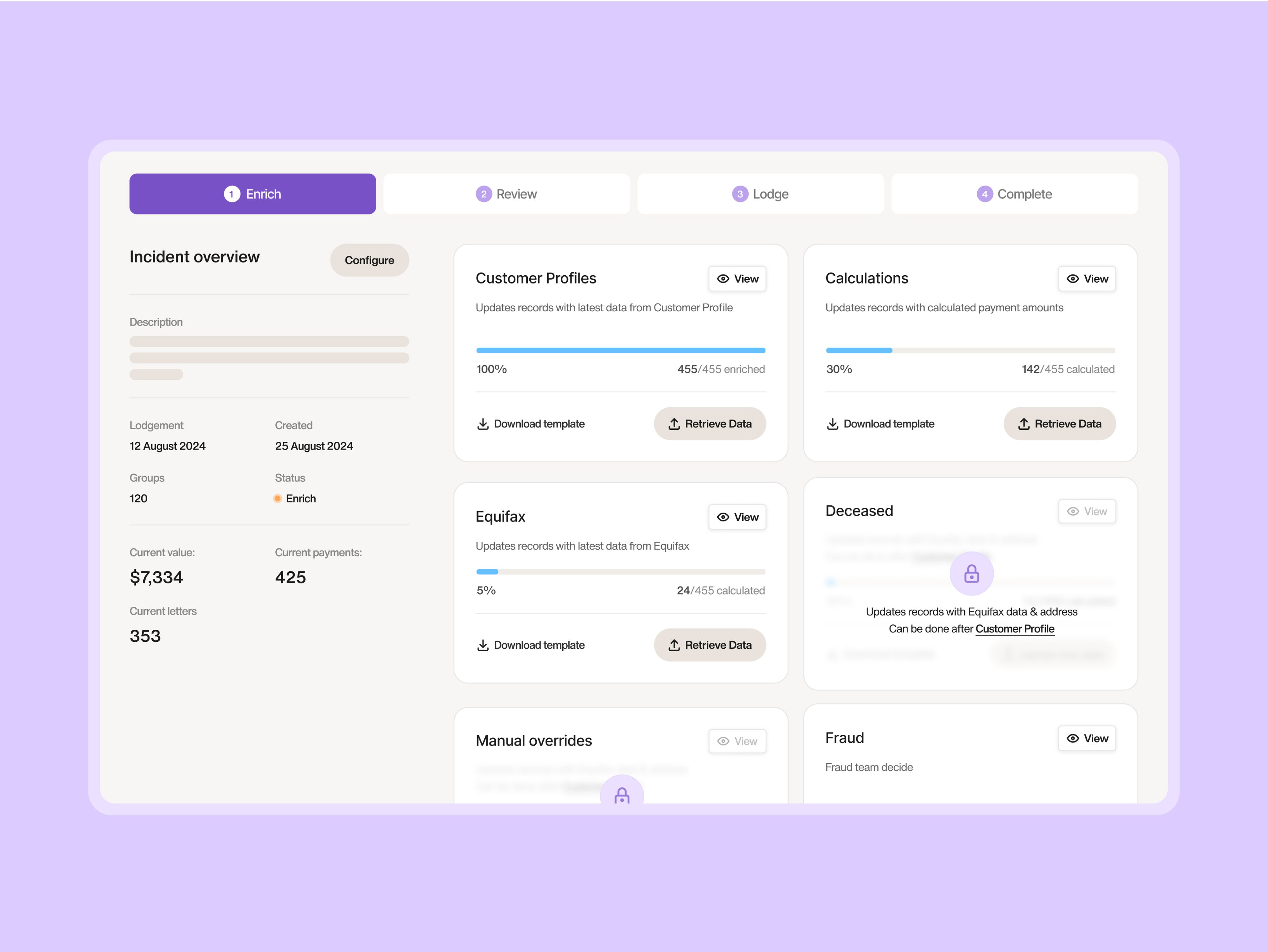

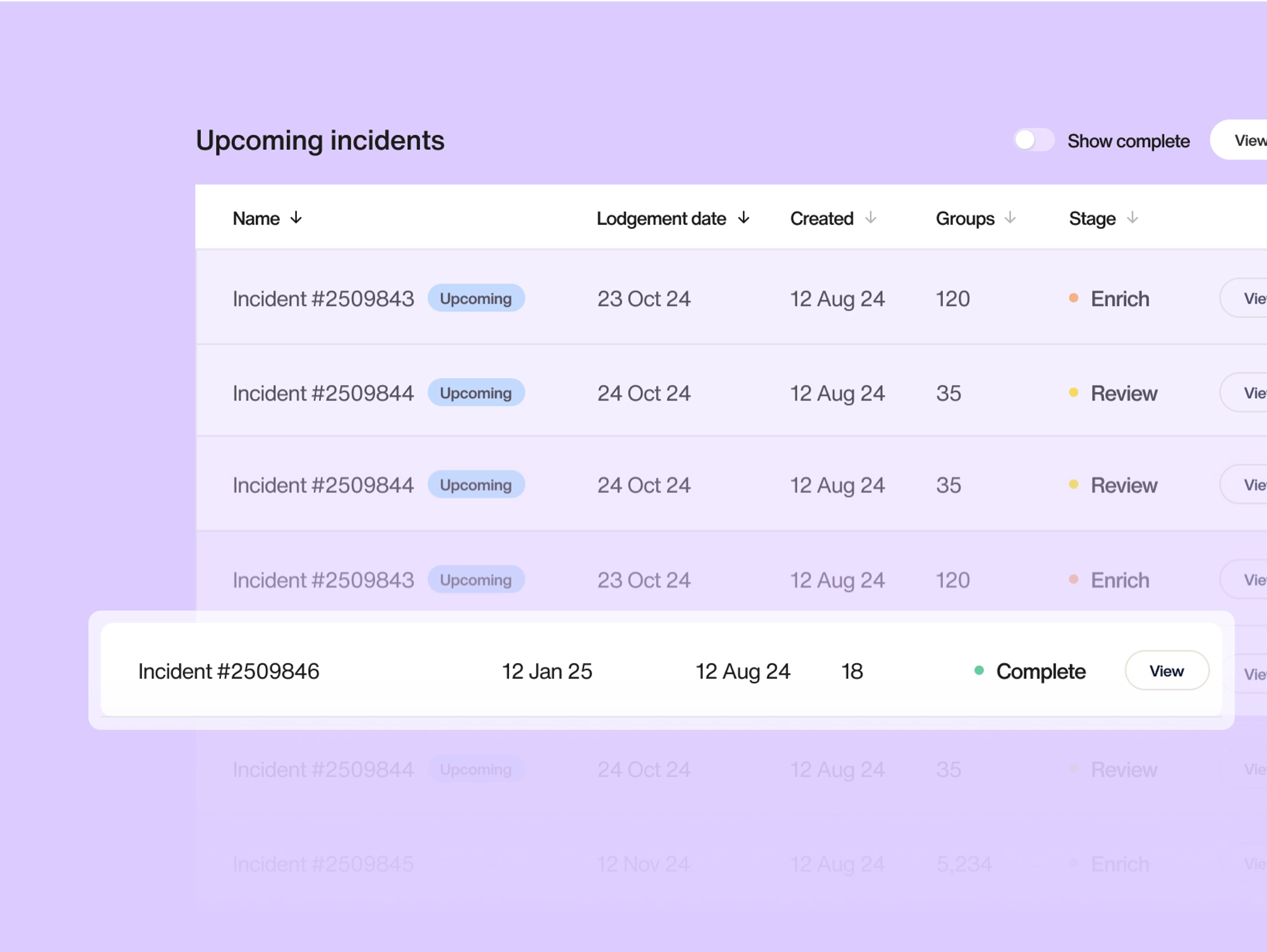

Tech teams often struggle with cumbersome integrations and disjointed tech stacks. Bluline’s Platform isn't just another CRM or ‘automated’ spreadsheet for remediation; it's an end-to-end solution engineered to seamlessly integrate with your secure infrastructure. Fast and cost-effective, the Platform overcomes traditional tech hurdles and transforms your remediation process.

4 month

Time to value

98%

Of cases automated from start to finish

$50M

In accurate payments automated

600%

Efficiency gain vs manual processing

Secure integration and data protection

The Platform integrates securely with your existing environment, safeguarding sensitive customer and bank data against security threats.

This seamless integration not only protects, but also enhances your data-handling capabilities, ensuring safety and compliance without disrupting workflows.

Speed, automation and flexibility

Experience the speed of the Platforms automation, which streamlines processes and improves overall operations.

Our platform closes cases from end to end in just four weeks. Plus, it’s designed for deployment within flexible IT infrastructures, adapting to evolving business needs and scaling with your bank’s growth.

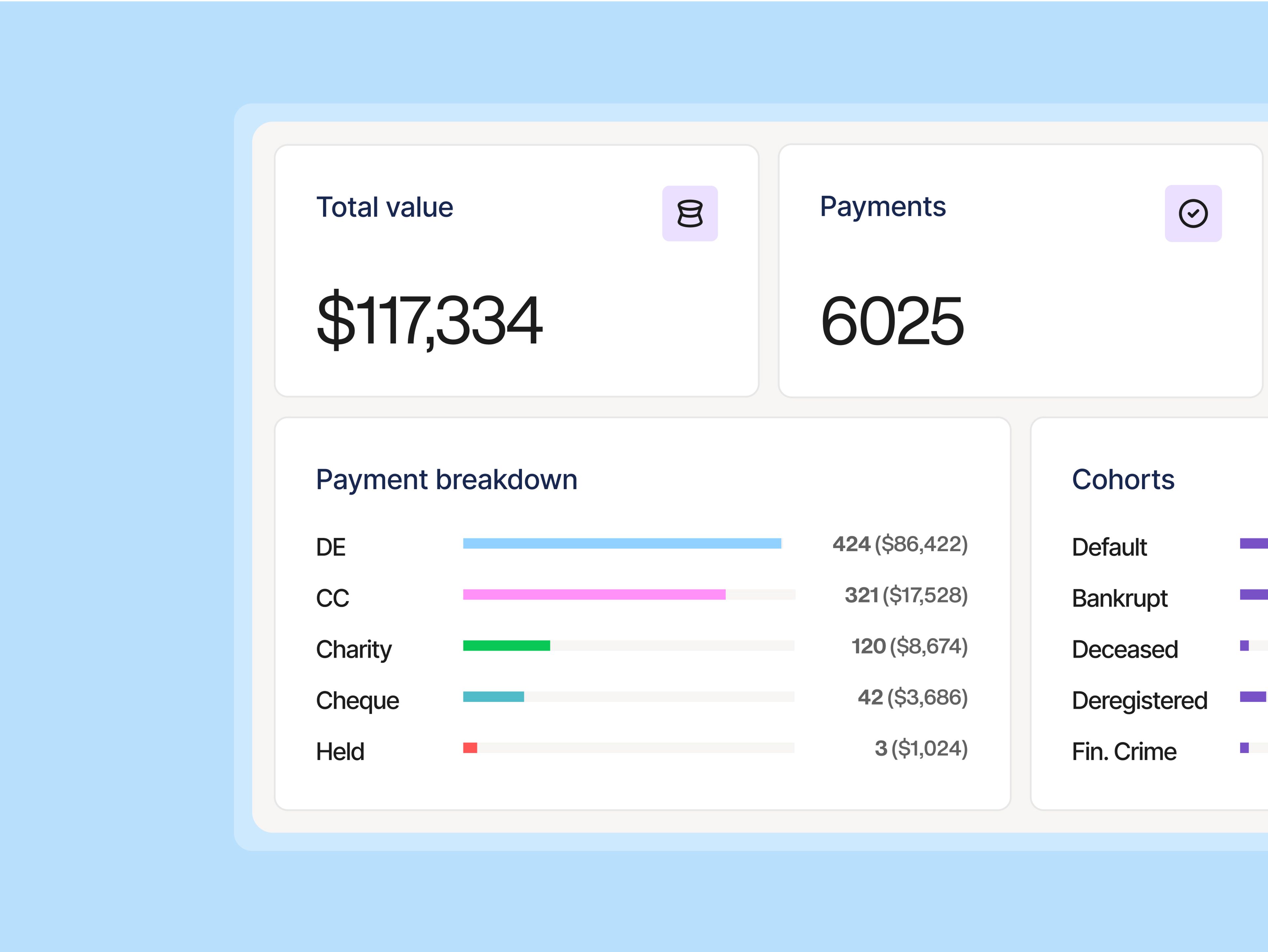

Precision at scale

When you integrate our Platform with your systems, you unlock the full potential of our automation technology to optimise your efficiency.

Bluline ensures that our technology meets the highest regulatory standards and compliance requirements. Remediated over 1 million Australian customers already

“Westpac has always been committed to delivering the best outcomes for its customers, and partnering with Bluline Technologies has allowed us to strengthen that commitment. Under my leadership, Bluline designed and built our automated remediation platform, transforming a previously complex and manual process into a streamlined, highly efficient solution.”

See how our platform can work for you

Watch a demo to see how our platform can revolutionise your bank's remediation efforts

Discover insights from Bluline

View all insightsView all insightsNavigate the complexities of banking regulations with this compliance guide to ensuring trust, transparency, and streamlined customer remediation.

Key metrics, strategies, and tools can help you gauge the impact of your bank’s customer remediation efforts so you can improve processes and deliver better outcomes.

FAQs

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline’s platform is not a bespoke build, but it is highly adaptable. The core software remains consistent, while we develop custom connectors and bespoke modules to seamlessly integrate with your bank’s existing systems. This ensures a tailored fit that meets your specific remediation needs without the complexity of a fully custom build.

Bluline’s platform ensures your bank’s data remains secure through robust encryption at rest on a database level and encryption in transit using the latest transport layer security (TLS) support. We implement zone management solutions and leverage the security of the broader banking ecosystem, all while operating within your secure environment to maintain compliance and data integrity.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.