Discover how end-to-end automation is revolutionising customer remediation in banking – addressing challenges, enhancing customer trust, and driving operational efficiency.

Solution

Automated remediation

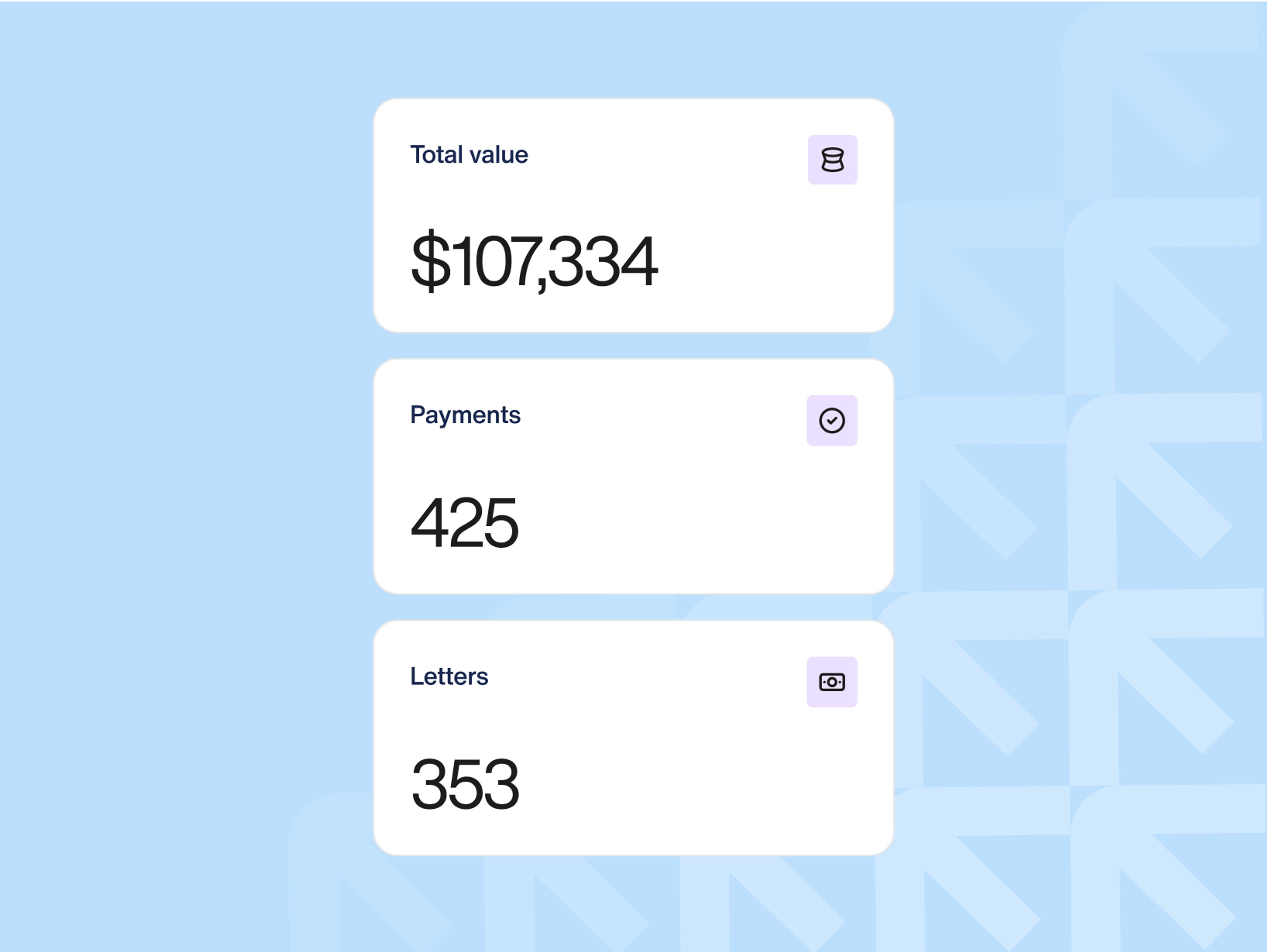

$50M and 1M customers remediated with our platform

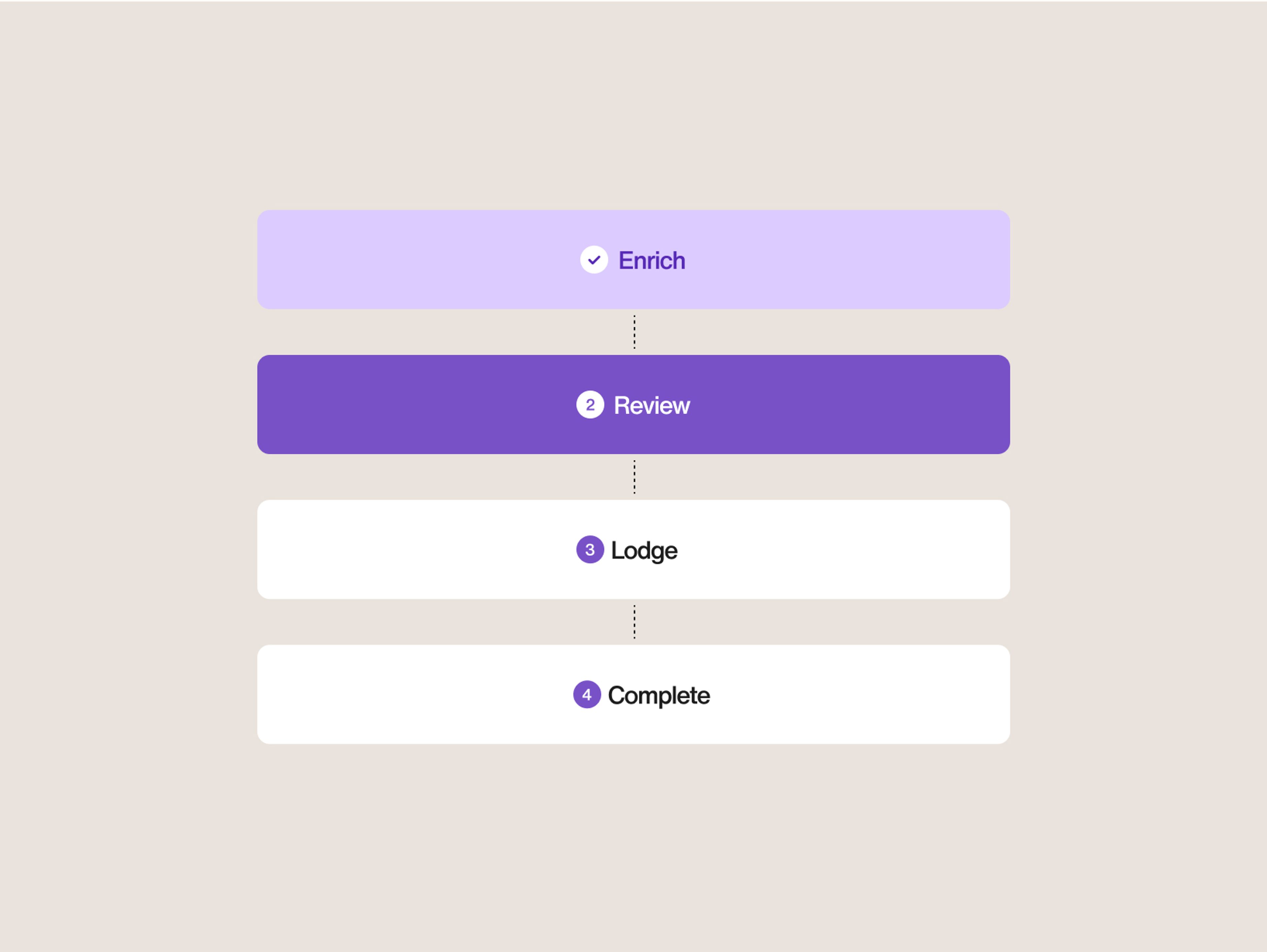

One institution’s remediation program might look different from another’s, but all break down into similar components.

Bluline’s technology-first and engineering-led approach tackles each of these components to automate even the most complex programs from start to finish working across consumer, business, and institutional banking.

Remediating your entire product suite – delivering results faster and at a fraction of the cost.

Trusted by leading banks across Australia

Automated end-to-end remediation

Get results faster and at a fraction of the cost.

- Reduce costs

- Mitigate financial and non-financial risk

- Speed up remediation

- Reduce customer backlog

Seamlessly integrated into your secure environment

Based on our deep understanding of both the problems remediation teams face and the technology needed to fix them, our platform:

- Tackles remediation

- Cuts through the layers of complexity from legacy systems

- Ensures effective collaboration and technical accuracy

Gain a competitive advantage

Bluline elevates your remediation efforts, transforming them from a cumbersome but necessary cost to a strategic asset and Net Promoter Score (NPS) driver. Our comprehensive RegTech solution:

- Offers a unique end-to-end approach

- Accelerates the remediation process and cuts costs

- Gives your bank the competitive edge

“What used to take up to 12 months can now be completed in four weeks, reducing annual remediation costs by half while doubling output. With more than $54 million in accurate payments processed, $51 million saved per year, and a 600% increase in fulfilment efficiency, this solution has been instrumental in clearing backlogs, improving compliance, and delivering faster, fairer outcomes for millions of customers.”

Automate remediation, accelerate resolution

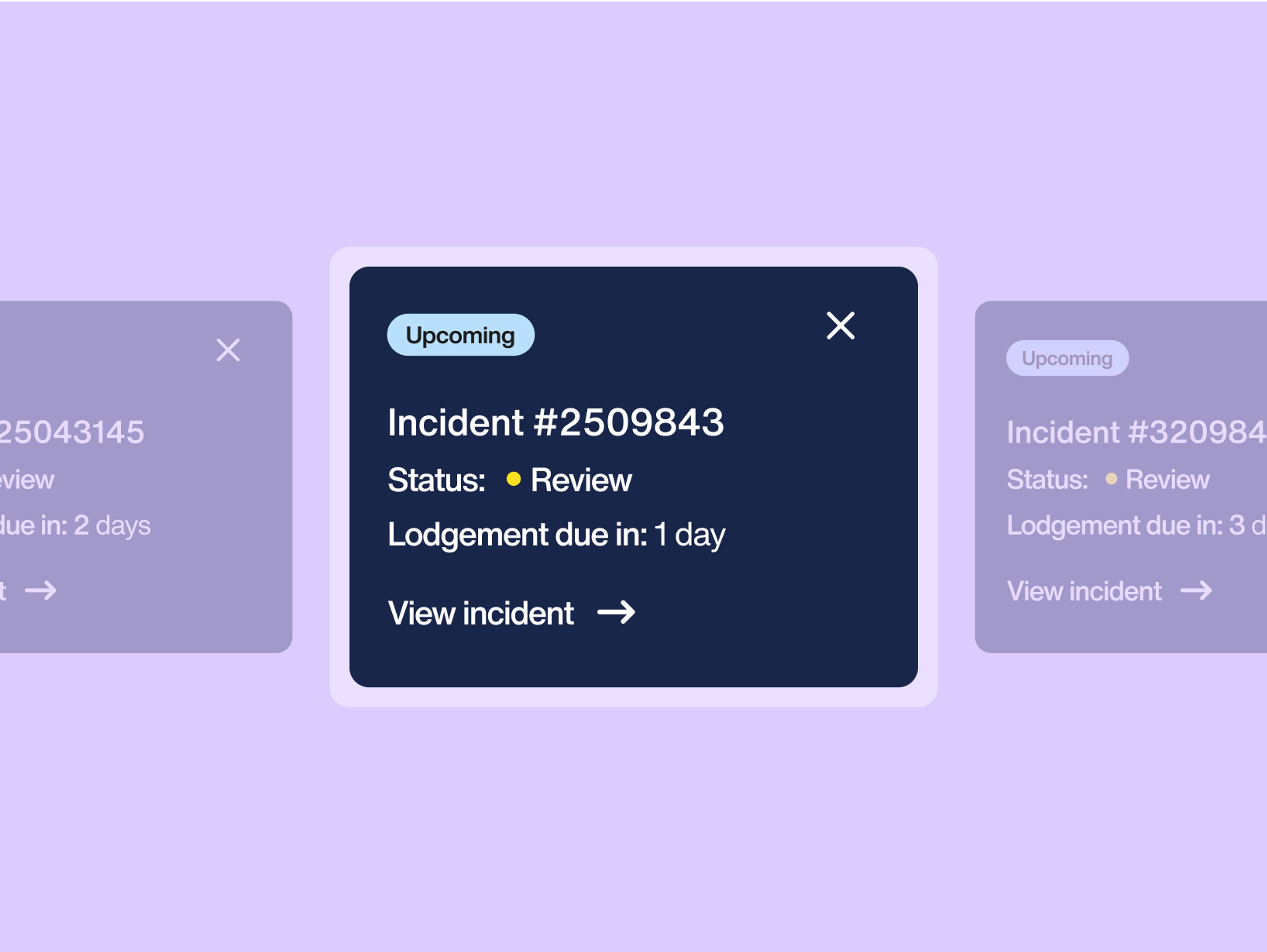

It's a common misconception that you cannot automate processes if they have a high degree of variance and complexity, but you can! Our approach actively automates your remediation from end to end – from identifying impacted customers to closing incidents.

1. Determine payment eligibility

Gather details of potentially impacted customers and rules for calculating impact

2. Calculate customer impact

Use rules to review identified customers to determine principal loss and other impacts

3. Conduct compliance checks

Check compliance to determine deceased customers, bankruptcy, fraud, and more

4. Generate email, letter, or SMS

Communicate specific incidents to customers, detailing how they’ve been impacted

5. Assign payment method

We cover every payment option, from payment into open accounts to payments to third parties – that is, ASIC or charity and exception scenarios

6. Execute and confirm payment

Ensure seamless execution and confirmation of remediation payments

7. Simplify customer follow-up

Streamline payment follow-ups, demonstrating reasonable efforts, with automated tracking and customer contact management

8. Close out incidents and charity payments

Gain clear closure, reporting, and transparency after completing payments

See how our platform can work for you

Watch a demo to see how our platform can revolutionise your bank's remediation efforts

Discover insights from Bluline

View all insightsView all insightsNavigate the complexities of banking regulations with this compliance guide to ensuring trust, transparency, and streamlined customer remediation.

Key metrics, strategies, and tools can help you gauge the impact of your bank’s customer remediation efforts so you can improve processes and deliver better outcomes.

FAQs

- General FAQs

- Executive

- Technology

- Payments

- Risk

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Absolutely! Bluline’s platform delivers proven results, successfully processing more than $50 million in payments to nearly 2 million Australian customers. It has efficiently managed more than 100 customer remediation incidents, helping banks streamline processes, reduce costs, and improve compliance. Our partner banks trust Bluline to transform their remediation efforts with measurable success.

Bluline’s platform is not a bespoke build, but it is highly adaptable. The core software remains consistent, while we develop custom connectors and bespoke modules to seamlessly integrate with your bank’s existing systems. This ensures a tailored fit that meets your specific remediation needs without the complexity of a fully custom build.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Manual customer remediation is slow, costly, and prone to human error; it can lead to inaccurate payments, compliance breaches, and regulatory fines. Fragmented processes create inefficiencies, and reliance on spreadsheets increases the risk of data inconsistencies. Without automation, banks struggle to manage backlogs, delaying resolutions and damaging customer trust and regulatory standing.

We’ve designed Bluline's platform to help banks mitigate both financial and non-financial risk – for example:

- Operational risk: Automated processes reduce manual errors and enhance consistency.

- Compliance risk: Built-in checks ensure adherence to regulatory standards such as ASIC's RG 277.

- Reputational risk: Transparent and timely remediation strengthens customer trust.

Absolutely not. Bluline’s platform was built from firsthand experience in banking remediation, addressing the inefficiencies of manual processes. It’s not just another tool – it’s a core solution that has transformed remediation for major financial institutions, automating entire departments and proving its value as an essential part of the banking ecosystem.

Bluline’s platform ensures your bank’s data remains secure through robust encryption at rest on a database level and encryption in transit using the latest transport layer security (TLS) support. We implement zone management solutions and leverage the security of the broader banking ecosystem, all while operating within your secure environment to maintain compliance and data integrity.

Bluline is compliant by design, ensuring all payments align with ASIC regulations and industry standards. Our platform performs automated compliance checks, generates audit-ready reports, and maintains complete transaction records. Real-time monitoring and rule-based processing help banks meet regulatory obligations while reducing compliance risks and manual errors.

Yes. Bluline offers confidential roundtable and executive whiteboard sessions to help banks assess their current customer remediation processes, identify challenges, and explore the impact of automation. These collaborative sessions provide valuable insights and strategic guidance. Contact us to learn how we can support your bank’s transformation.

Let’s talk! Bluline is growing, and we’re always looking for world-class engineers and professionals to join our team. If you’re passionate about innovation, automation, and transforming financial services, we’d love to hear from you. Reach out today and start a conversation that could change your career.

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Absolutely! Bluline’s platform delivers proven results, successfully processing more than $50 million in payments to nearly 2 million Australian customers. It has efficiently managed more than 100 customer remediation incidents, helping banks streamline processes, reduce costs, and improve compliance. Our partner banks trust Bluline to transform their remediation efforts with measurable success.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline’s platform is not a bespoke build, but it is highly adaptable. The core software remains consistent, while we develop custom connectors and bespoke modules to seamlessly integrate with your bank’s existing systems. This ensures a tailored fit that meets your specific remediation needs without the complexity of a fully custom build.

Bluline’s platform ensures your bank’s data remains secure through robust encryption at rest on a database level and encryption in transit using the latest transport layer security (TLS) support. We implement zone management solutions and leverage the security of the broader banking ecosystem, all while operating within your secure environment to maintain compliance and data integrity.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Bluline automates every stage of the payment process, from determining eligibility to executing and confirming transactions. Our platform integrates with your bank’s systems to streamline calculations, generate payment instructions, and process transactions at scale – reducing manual effort, improving accuracy, and ensuring payments are made quickly and compliantly.

Yes. Bluline supports a range of payment methods, including direct deposits, cheques, BPAY, ASIC payments, charity donations, and other third-party transactions. The platform intelligently assigns payment methods based on customer profiles and regulatory requirements, ensuring seamless execution across all scenarios while maintaining compliance.

Bluline’s platform applies rule-based calculations and automated compliance checks to ensure payments are accurate. It validates transaction amounts, cross-checks against customer data, and detects discrepancies before processing. By eliminating manual calculations, Bluline reduces the risk of human error, ensuring that customers receive the correct payments every time.

Bluline includes an automated exception-handling framework that flags and categorises payment failures. It can identify incorrect account details, compliance restrictions, and other issues, triggering alerts for remediation teams or auto-reprocessing where possible. Custom workflows ensure failed transactions are quickly resolved, minimising delays and maintaining customer satisfaction.

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Bluline’s platform ensures your bank’s data remains secure through robust encryption at rest on a database level and encryption in transit using the latest transport layer security (TLS) support. We implement zone management solutions and leverage the security of the broader banking ecosystem, all while operating within your secure environment to maintain compliance and data integrity.

We’ve designed Bluline's platform to help banks mitigate both financial and non-financial risk – for example:

- Operational risk: Automated processes reduce manual errors and enhance consistency.

- Compliance risk: Built-in checks ensure adherence to regulatory standards such as ASIC's RG 277.

- Reputational risk: Transparent and timely remediation strengthens customer trust.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.