Discover how end-to-end automation is revolutionising customer remediation in banking – addressing challenges, enhancing customer trust, and driving operational efficiency.

Risk roles

Trusted by leading banks across Australia

Compliant by design

Those in risk-focused roles are no strangers to banking’s compliance and reputational challenges.

Bluline’s Platform addresses these risks head-on, ensuring your bank meets regulatory requirements with precision, reducing compliance concerns and protecting your reputation through reliable automated remediation processes.

187

Remediation lodgments to date

1M

Customer remediation payments made

$50M

Accurate payments back to customers

100

Incidents completed with our platform

Secure within your bank

Our Platform fits within your bank's secure systems, prioritising data protection and customer security against external threats.

This integration emphasises risk mitigation in data handling and safeguards sensitive information, maintaining high standards of security in every interaction.

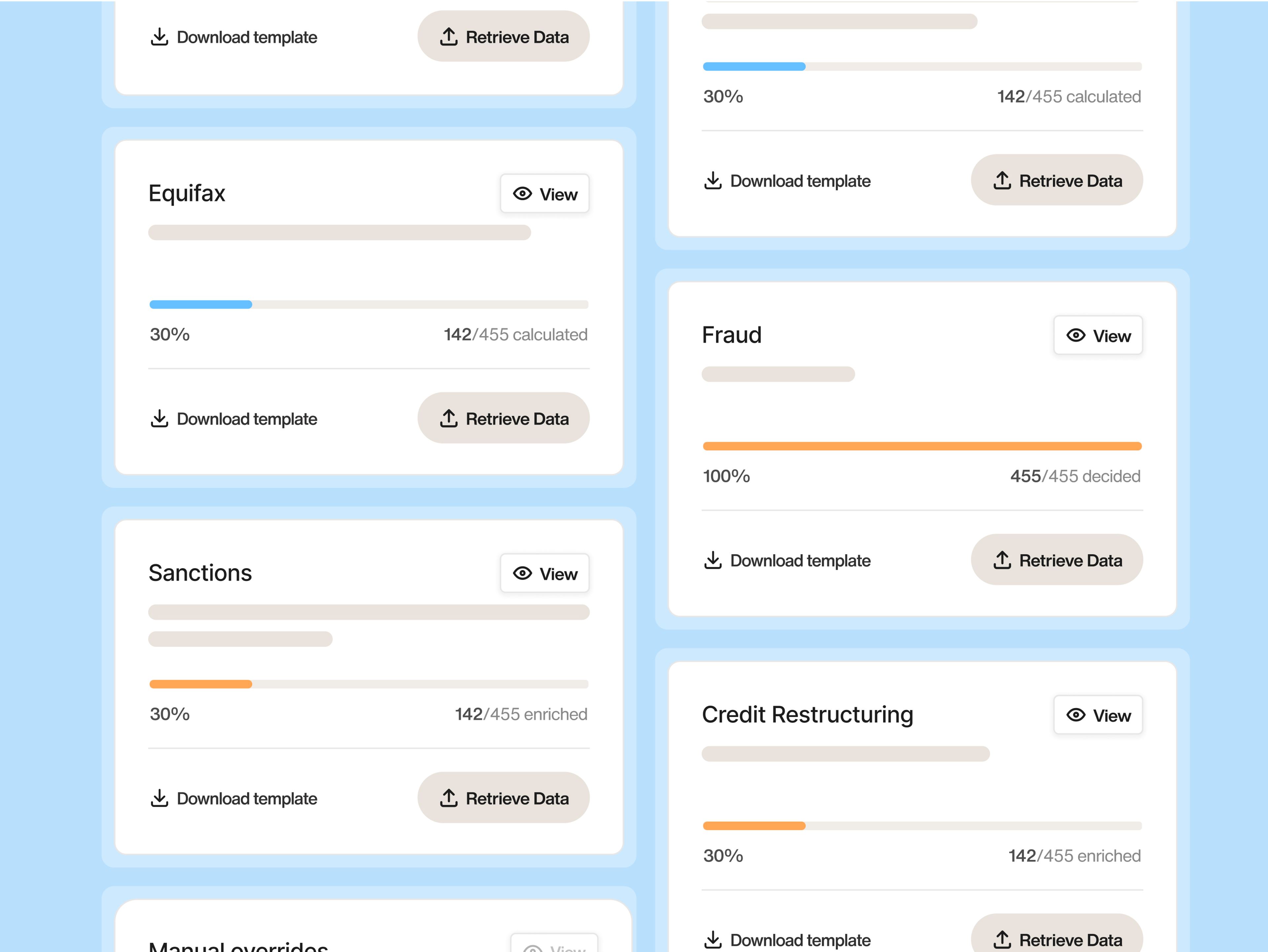

Scalable accuracy

For risk professionals, Our Platform provides precision at scale, enhancing your ability to manage and analyse large volumes of remediation payments/letters accurately.

Its seamless integration ensures that every data point is handled with the utmost accuracy, supporting rigorous risk assessments and decision-making processes without compromising data integrity. You get the correct result, everytime

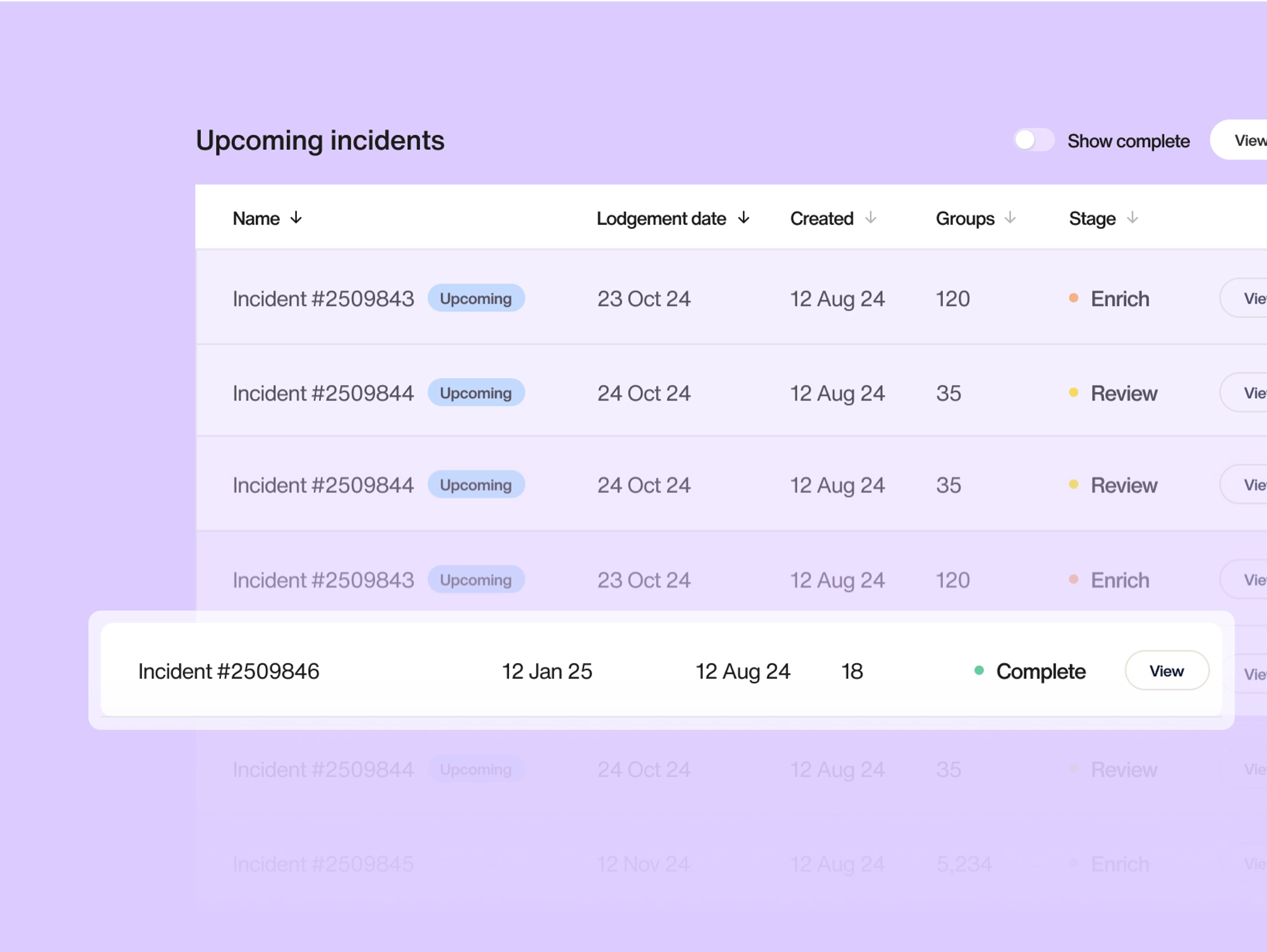

Compliance at speed without the human error

The Platform automates data collection, calculations, and remediation payment processing, minimising the need for human intervention – and human error.

For risk professionals, this means you achieve compliance faster and more reliably, ensuring that each step of remediation meets regulatory standards with enhanced precision.

“What used to take up to 12 months can now be completed in four weeks, reducing annual remediation costs by half while doubling output. With more than $54 million in accurate payments processed, $51 million saved per year, and a 600% increase in fulfilment efficiency, this solution has been instrumental in clearing backlogs, improving compliance, and delivering faster, fairer outcomes for millions of customers.”

See how our platform can work for you

Watch a demo to see how our platform can revolutionise your bank's remediation efforts

Discover insights from Bluline

View all insightsView all insightsNavigate the complexities of banking regulations with this compliance guide to ensuring trust, transparency, and streamlined customer remediation.

Key metrics, strategies, and tools can help you gauge the impact of your bank’s customer remediation efforts so you can improve processes and deliver better outcomes.

FAQ

Bluline’s platform is an end-to-end customer remediation solution designed specifically for banks and financial institutions. It automates every stage of the remediation process – from identifying impacted customers and calculating losses to executing payments, ensuring compliance, and tracking follow-ups.

Bluline’s platform ensures your bank’s data remains secure through robust encryption at rest on a database level and encryption in transit using the latest transport layer security (TLS) support. We implement zone management solutions and leverage the security of the broader banking ecosystem, all while operating within your secure environment to maintain compliance and data integrity.

Bluline’s platform is deployed securely within your bank’s infrastructure, either on-premise or in a banking virtual private cloud (VPC). We tailor installations to fit your needs, whether a bare metal or full-cloud solution, using Terraform for seamless deployment. Our team ensures a smooth, secure integration with minimal disruption to operations.

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.