Discover how end-to-end automation is revolutionising customer remediation in banking – addressing challenges, enhancing customer trust, and driving operational efficiency.

Easing your payment pain points

Payments roles

Trusted by leading banks across Australia

Easing your payment pain points

People in payment roles face inevitable challenges with accuracy and manual processing.

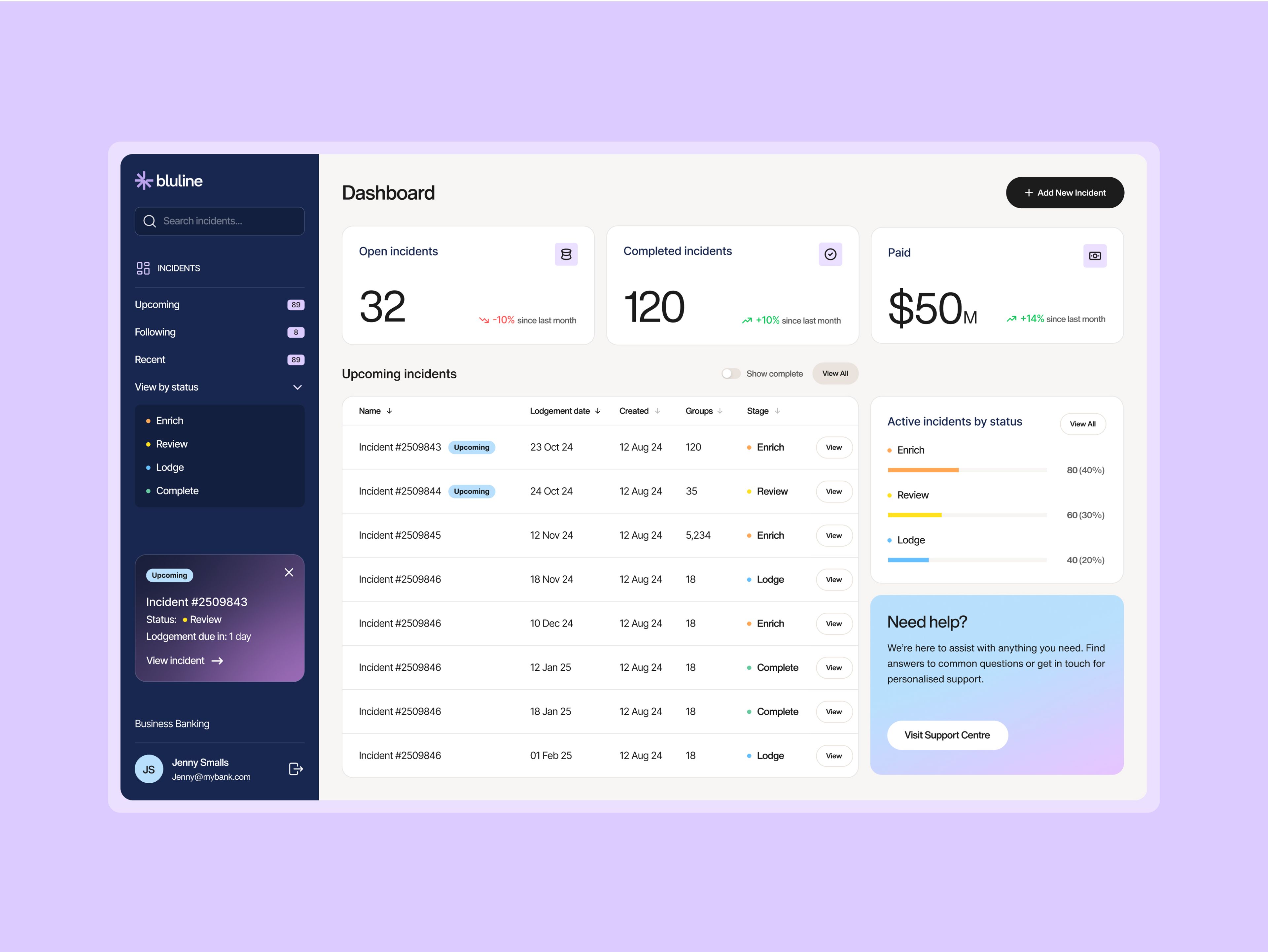

Bluline's Platform automates end-to-end customer remediation, mitigating human error; streamlining labour-intensive tasks; and ensuring payments are calculated, communicated, and completed correctly the first time, every time through our technology-first approach platform.

4 week

Customer remediation cycle

1M

Customers (and counting) remediated

$50M

Payments made to date through Platform automation

187

Remediation lodgments to date

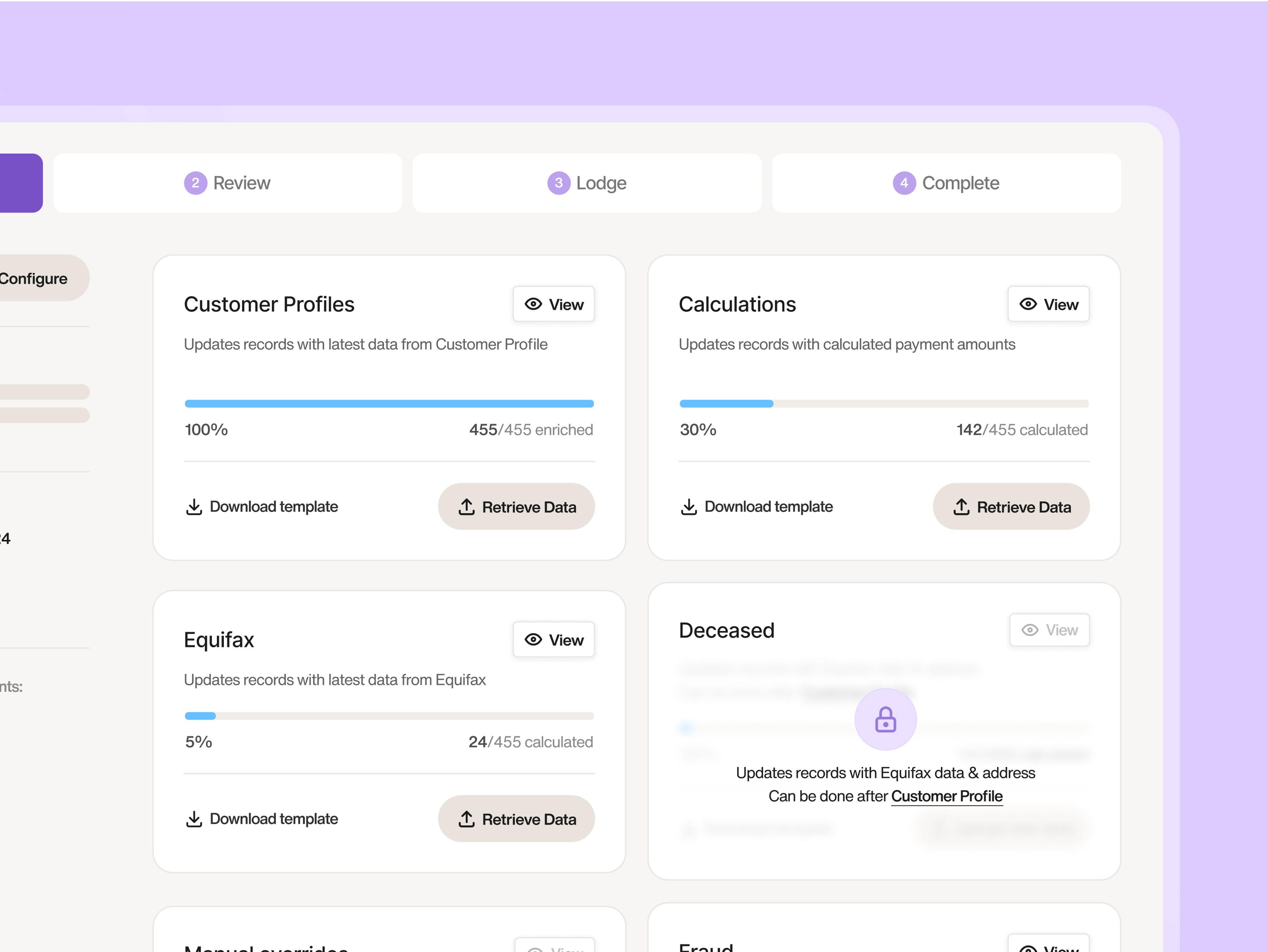

Streamlined calculations, communications, and payments

With the Platform, banks can automate the entire remediation journey – from calculations to communications and direct payments.

Eliminate the need for manual processing across various payment types, customer communication, and reporting, ensuring accuracy and efficiency without the usual headaches.

Handling exceptions with ease

The Platform automates an average of 98% of customer remediations.

For the few cases that require human intervention due to exceptional circumstances or non-compliance with predefined rules, our system flags these for your team, facilitating easy completion with reasonable efforts and follow-up.

Unmatched capability and competitive edge

Our Platform empowers your team to process multiple incidents monthly, generate personalised letters for thousands of customers, and finally clear that persistent backlog of cases.

This boosts your operational capacity and provides you with a significant competitive advantage in customer remediation management.

"Bluline’s technology and engineering-first approach ensured seamless integration with our existing systems, allowing for minimal disruption and maximum impact. Their team worked hand in hand with Westpac and embedded themselves within our operations to create a tailored solution that meets both regulatory and business needs. Their deep collaboration, expertise, and commitment to delivering real results have been game-changing for the bank."

See how our platform can work for you

Watch a demo to see how our platform can revolutionise your bank's remediation efforts

Discover insights from Bluline

View all insightsView all insightsNavigate the complexities of banking regulations with this compliance guide to ensuring trust, transparency, and streamlined customer remediation.

Key metrics, strategies, and tools can help you gauge the impact of your bank’s customer remediation efforts so you can improve processes and deliver better outcomes.

FAQ

Bluline partners closely with your bank to ensure seamless integration and optimal results. Our team collaborates to understand your specific needs, tailoring your automation solution with flexible, bespoke modules. During implementation, our experts work onsite, embedded within your team to provide hands-on training and support. A dedicated account director oversees the project, ensuring ongoing alignment with your bank’s unique processes. Our goal is a smooth transition and long-term success in automating customer remediation.

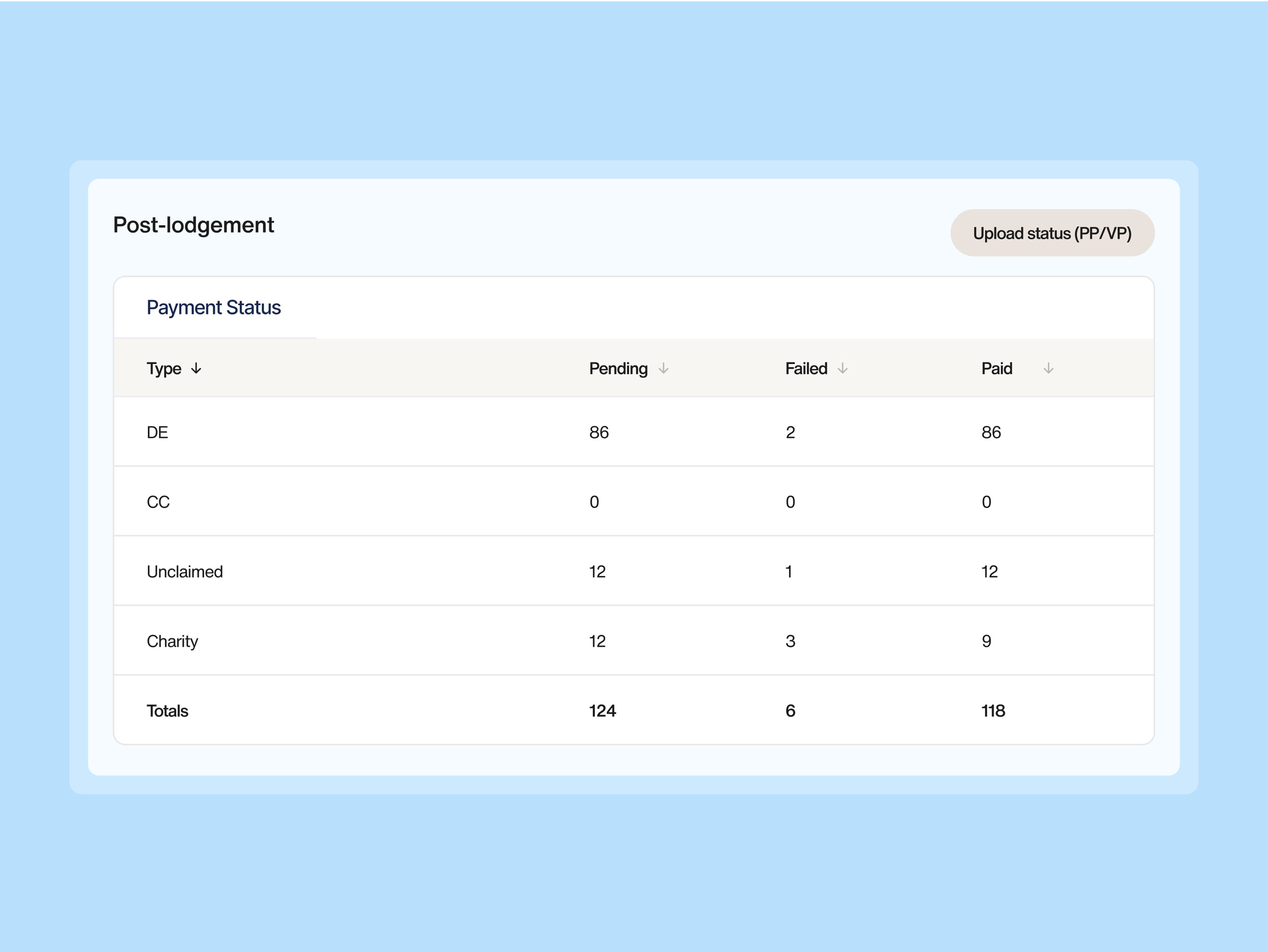

Bluline automates every stage of the payment process, from determining eligibility to executing and confirming transactions. Our platform integrates with your bank’s systems to streamline calculations, generate payment instructions, and process transactions at scale – reducing manual effort, improving accuracy, and ensuring payments are made quickly and compliantly.

Yes. Bluline supports a range of payment methods, including direct deposits, cheques, ASIC payments, charity donations, and other third-party transactions. The platform intelligently assigns payment methods based on customer profiles and regulatory requirements, ensuring seamless execution across all scenarios while maintaining compliance.

Bluline’s platform applies rule-based calculations and automated compliance checks to ensure payments are accurate. It validates transaction amounts, cross-checks against customer data, and detects discrepancies before processing. By eliminating manual calculations, Bluline reduces the risk of human error, ensuring that customers receive the correct payments every time.

Bluline includes an automated exception-handling framework that flags and categorises payment failures. It can identify incorrect account details, compliance restrictions, and other issues, triggering alerts for remediation teams or auto-reprocessing where possible. Custom workflows ensure failed transactions are quickly resolved, minimising delays and maintaining customer satisfaction.

Bluline is built with compliance at its core, ensuring all payments align with ASIC RG277 regulations and industry standards. The platform performs automated compliance checks, generates audit-ready reports, and maintains complete transaction records. Real-time monitoring and rule-based processing help banks meet regulatory obligations while reducing compliance risks and manual errors.

Yes. Bluline’s platform seamlessly integrates with your bank’s existing payment infrastructure and financial systems. Whether you use legacy systems or modern cloud-based platforms, Bluline connects through secure application programming interfaces (APIs) and custom connectors, ensuring smooth data exchange. This allows for real-time payment processing, reconciliation, and compliance reporting without disrupting workflows.

Start your journey today and gain a competitive advantage with Bluline's automated customer remediation platform.